“[Barack Obama] is our first African American president; or he will be. And we wish him well. But his choice, basically, is whether he’s going to be Uncle Sam for the people of this country, or Uncle Tom for the giant corporations.”

American President Barack Obama

Uncle Tom is the title character from Harriet Beecher Stowe’s novel Uncle Tom’s Cabin, published in 1852. Tom was a Christian slave on a Kentucky plantation. Throughout the novel Tom remained loyal to his master, refusing to physically resist the abuse and torment that he and his fellow slaves were forced to endure. It was Tom’s belief that their captivity was the destiny that God had chosen for them, therefore must be accepted.

In modern times, the term “Uncle Tom” was adopted by African-Americans as a pejorative to condemn fellow African-Americans whom they accused of “selling out” to Caucasian-Americans. An Uncle Tom is now understood to be a black person “who is perceived as behaving in a subservient manner to white authority figures, or as seeking ingratiation with them by way of unnecessary accommodation.”

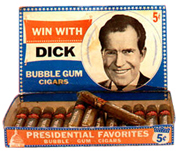

On November 4, 2008, when it became obvious that Barack Obama had won the Presidential election, Ralph Nader was interviewed by FOX News Anchor Shepard Smith.

The following exchange is the FOX interview:

Smith: “Guess who’s here? The Independent party candidate, Ralph Nader. This is his second run for the Presidency since he played spoiler in the close 2000 contest. This year he was on the ballot in 45 states plus D.C. This year he was polling about 1-percent. Ralph, you spoke to Fox News Radio’s Houston affiliate today, and said this:

‘To put it very simply, he is our first African American president; or he will be. And we wish him well. But his choice, basically, is whether he’s going to be Uncle Sam for the people of this country, or Uncle Tom for the giant corporations.’

Smith: “Really. Ralph Nader – what was that?”

Nader: “It’s very simple. He has gone along with corporate power from the moment he entered politics in the State Senate; voted for the Wall Street bailout; supports expanding [the] military budget that is desired by the military industrial complex, and doesn’t really have a tax reform thing for the ordinary fellow in this country. [He] apposes single-payer full Medicare for all, because the giant HMOs AETNA and SIGNA do. [He] doesn’t have a living wage; he’s supposed to be respectful of the poor [but] hardly mentions them in his speeches – it’s all the middle class. He doesn’t have a comprehensive program…”

(Interrupted by Smith)

Smith: “And you utter the words ‘Uncle Tom’? Are you kidding me?”

Nader: “Yeah. That’s the question he’s gotta face.”

Smith: “He didn’t have to face it until it came out of your mouth! I mean, I just wonder if you don’t realize that you had a number of supporters out there. You were running a percentage this year, you were reduced to irrelevant, and I just wonder now if that’s what you want your legacy to be – the man who, on the night that the first African American President in the history of this nation was elected, you ask if he’s going to be Uncle Sam or Uncle Tom.”

Nader: “Yeah, of course. He’s turned his back on a hundred-million poor people in this country – African Americans and Latinos and poor Whites, and we’re gonna hold them to a higher standard. It’s just not an unprecedented career move, ya know, in the White House. We expect more of Barack Obama…”

(Interrupted by Smith)

Smith: “You were reduced to complete irrelevance here. You weren’t able to play spoiler. Will you run again?”

Nader: “Look, I don’t like bullies like you. I can’t see you. You can pull the plug on me. I’m lookin’ at a dark camera…”

(Interrupted by Smith)

Smith: “You said “Uncle Tom”. I didn’t say it, sir. With respect, I did not say it.”

Nader: “I said that’s the question HE has to answer. He can become a great President, or he can become a toady for the corporate powers that have brought both parties to their knees against working people in this country and have allowed our country to be hijacked by global corporations who have no allegiance to this country other than to ship its jobs and industries to fascist and communist dictators abroad who know how to keep their workers in their place. This is reality here. This is not show business. It’s not celebrity politics. There are people suffering in this country, and we expect a great Presidency from Barack Obama, and we’re gonna try to hold his feet to the fire…”

(Interrupted by Smith)

Smith: “I just wonder if, in hindsight, you wish you’d used a phrase other than Uncle Tom.”

Nader: “Not at all. Do you know what the historic…”

(Interrupted by Smith)

Smith: “Fair enough. Thanks very much. We’ll have a response from our panel in just a moment.”

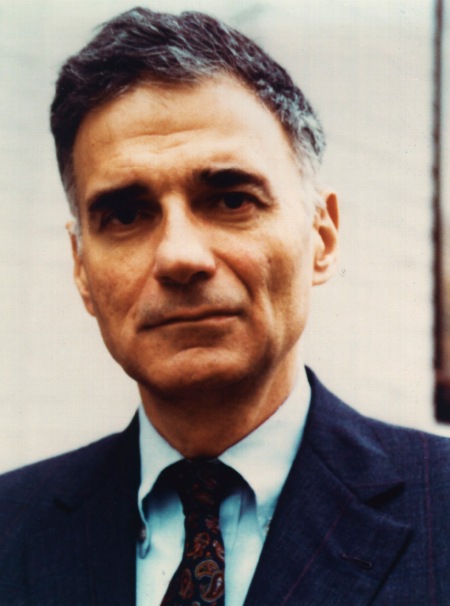

Public Activist Ralph Nader

For several days afterward, the media was awash with stories claiming that Ralph Nader had called Barack Obama an “Uncle Tom”, even though he hadn’t. As well, none of this coverage addressed the issues that Nader had highlighted in his interview with Shepard Smith.

These follow-up stories invariably portrayed Nader as the “spoiler” from the 2000 presidential election, depicting him as a bitter, “also-ran” candidate who was reduced to name calling and invective out of personal spite. Whatever the intent behind this universally biased coverage, the result was a pillorying of Nader, and by inference a pillorying of the substance behind the issues that Nader attempted to address before the American public.

Amidst the media euphoria of this historic election, it was understandable that few people cared to listen to Ralph Nader’s reservations regarding the president-elect and his intentions after assuming office, but it was also disheartening that these legitimate concerns could not be seriously addressed in the public forum. The United States had entered into a period of economic crisis not seen since the Great Depression of 1929, and it was entirely reasonable for Nader to ask where Obama’s loyalties lay – with the country’s wealthy minority or with the citizen majority who voted for him.

FDR’s domestic reforms: a historical precedent for Obama

Ever since Franklin D. Roosevelt’s momentous election victory of 1932 and the Democratic Party’s simultaneous sweep of the congressional elections, every presidential administration since has been scrutinized in the media by the decisive standard of legislative action taken during the first hundred days of FDR’s first presidential administration. In the wake of catastrophic economic upheavals fuelled by decades of political corruption and corporate patronage, the people of the United States had voted overwhelmingly for a change in the political tradition that dominated their federal government. They would not be disappointed.

Upon accepting the 1932 Democratic nomination for president, Roosevelt proclaimed: “Throughout the nation men and women, forgotten in the political philosophy of the Government, look to us here for guidance and for more equitable opportunity to share in the distribution of national wealth… I pledge myself to a new deal for the American people.”

With this mandate, the President introduced the “New Deal”, its policies focusing on what historians call the 3 Rs: relief, reform and recovery. Financial relief was provided for the unemployed and poor, while economic reforms of the monetary system were introduced to curtail usury by banks and irresponsible speculation by investors. In his inaugural address, Roosevelt declared: “Practices of the unscrupulous money changers stand indicted in the court of public opinion, rejected by the hearts and minds of men . . . The money changers have fled from their high seats in the temple of our civilization.”

Among FDR’s early reforms was the Banking Act of 1933, commonly known as the Glass–Steagall Act, which effectively barred banks, brokerages and insurance companies from entering one another’s’ industries, and separated investment banking from commercial banking. The law was enacted to control corruption and manipulation of the market by giant banks that had organized huge corporate mergers for their own profit, a primary factor behind the stock market collapse of 1929. By doing so, the administration had established a series of restraints on private financiers with the intent of tempering the impact of future economic downturns on the American economy; no longer would those with control over America’s finances be allowed to put all of the country’s economic eggs into one corporate basket.

These reforms arose in reaction to the unrestrained free market capitalism evolved by the “unscrupulous money changers” of American business.

History repeats itself

It was in reaction to another series of catastrophic economic upheavals fuelled by political corruption and corporate malfeasance that America’s voters again provided the Democratic Party with an overwhelming mandate for change. In November of 2008 Barack Obama was elected to the presidency, and the Democrats held majority control in both houses of Congress. Obama had campaigned on the slogans “It’s time for change” and “Change we can believe in.” Once again it was clear that Americans had voted for a change in the status quo pervading their government’s policies; conducting “business as usual” would not be acceptable.

Now that the excitement and emotion of the 2008 election has waned, and Barack Obama’s administration has almost completed its second year, it is much easier for the casual observer to be more thoughtful in assessing Obama as a leader – of both his party and the country. It is also far easier now to evaluate whether or not Ralph Nader’s concerns on the eve of Obama’s election were justified.

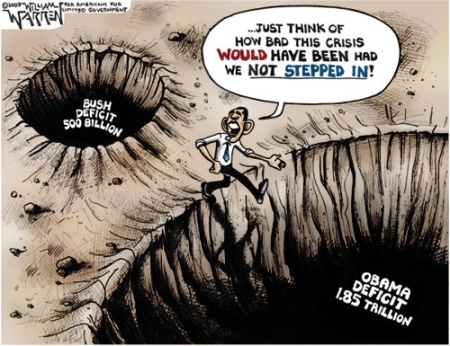

As with Roosevelt, the first 100 days of Obama’s administration would be marked by swift domestic policy initiatives, although not those anticipated by rank-and-file Democrats. Wall Street and the global corporations would be the President’s primary concern.

Obama’s domestic policies

On November 4, 2008, Ralph Nader was critical of Obama because he voted for the Wall Street bailout initiated by the Bush administration. The first priority of the new administration’s fiscal policy was to “increase financial support” (more bailouts) for private sector institutions already receiving government aid through the Troubled Assets Relief Program (TARP). In February of 2009 an additional 700 billion dollars was allocated to the program, but depending on one’s source of information this number varies; no absolute accounting of government spending has ever been attempted. Estimates of how much money will be eventually repaid to the government also vary.

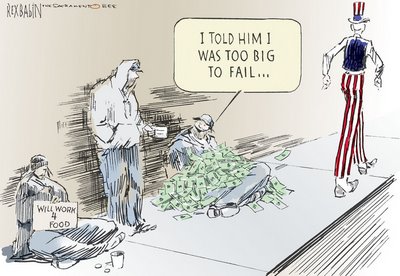

The consensus among economic pundits featured in the mainstream media was that these measures, however poorly implemented, were absolutely necessary in order to avoid an even greater financial catastrophe. An economic “domino effect” ending in universal bankruptcy was imagined for America without this massive government bailout. It was never made clear, however, why a handful of huge financial corporations were chosen as the recipients of this prodigious outpouring of public largesse while smaller regional institutions and individual citizens were excluded, other than to describe the giant firms as “too large too fail”.

Interdependency now exists among the country’s largest banks, brokers and insurance providers. Conglomerates are currently allowed to provide any financial service through divisions and subsidiaries, essentially utilizing the assets of one as collateral to underwrite the liabilities of another.

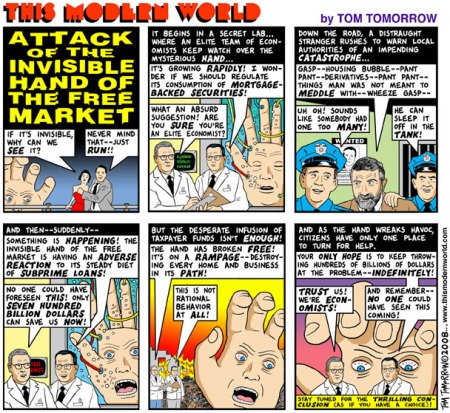

Dismantling the checks and balances

The provisions of the Glass–Steagall Act had been gradually eroded until the passing of the Financial Services Modernization Act of 1999, or Gramm-Leach-Bliley Act, which finally allowed commercial banks, investment banks, securities firms, and insurance companies to consolidate. This Act was the successful culmination of decades of corporate lobbying for deregulation of the financial sector of the American economy. Once again, those with control over America’s finances put all of their economic eggs into one corporate basket. Financial institutions were allowed to grow beyond the economy’s ability to absorb individual bankruptcies without disrupting the entire system.

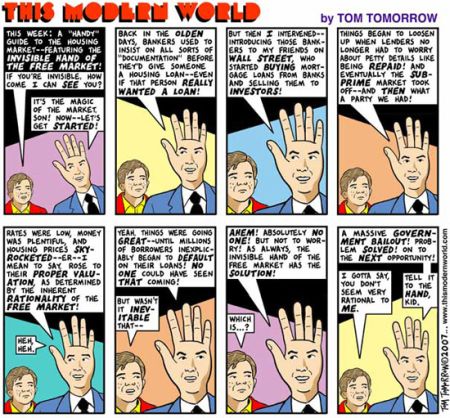

Throwing caution to the wind

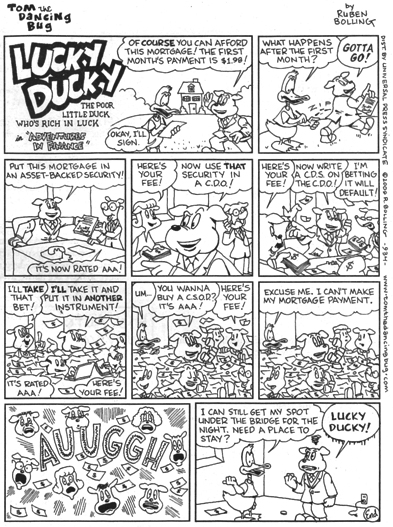

Just as disturbing was the increase in new “financial products” created for the benefit of speculators during this period of dismantling federal regulation. The primary feature of these new products was the expanded underwriting of risk in order to promote the sale of derivatives, securities and investment funds. Significant short-term profits provided the enticement for investors, but simultaneously they were exposed to long-term liabilities and asset devaluation should there be a downturn in the market. These products, especially hedge funds, found enthusiastic buyers in the guise of institutional investors (corporate executives), who both borrowed and invested other people’s money, and who realized huge commissions for themselves by returning short-term profits on paper.

Compounding the inherent risks of these financial products was the fact that speculators employed by most of the world’s major conglomerates had invested in the same high-risk products. This network of interdependency was built upon a foundation of non-existent assets, and would be exposed as such during the subprime mortgage crisis of 2006.

In the decade prior to the crisis, the vast majority of U.S. mortgages were issued to subprime borrowers accepting adjustable-rate mortgages. After U.S. housing prices peaked in mid-2006 and began a steep decline thereafter, refinancing became more difficult. Adjustable-rate mortgages were renewed at significantly higher rates, forcing homeowners to default and foreclosures to soar. As a result, securities and hedge funds backed by subprime mortgages lost most of their value, which cascaded as losses into other sectors of the world’s financial investment markets.

These mortgage-backed securities (MBS), with their initially high returns, had enticed investors from around the world to invest in the U.S. securities market. As housing prices declined, financial institutions that had borrowed and invested heavily in subprime MBS reported significant losses. As a result, defaults and losses on other loan types also increased and the crisis expanded from the housing market to other parts of the economy.

Effects on global stock markets due to the crisis were dramatic. Between January and October 2008, owners of stocks in U.S. corporations had suffered about 8 trillion dollars in losses, with holdings declining in value from 20 trillion to 12 trillion dollars. The financial institutions Goldman Sachs, AIG, Morgan Stanley, JPMorgan Chase, Citigroup, Bank of America, and Wells Fargo were not be able to honour their debts as a result, and would have forfeited without government intervention.

Subsidizing the rich

Rather than allow the defaulting American-based companies to declare bankruptcy then liquidate their remaining assets as dictated by law, the federal government of the United States borrowed money at the public’s expense to rescue them from bankruptcy – the American Government (American taxpayer) paid their debts, much of which involved payments to overseas institutions. This bailout was justified as an attempt to “stabilize the world’s economic markets” (maintain the status quo). Other governments would follow America’s lead. Underwriting the debt of these wayward institutions transformed their private sector liabilities into global public debt, while allowing them to continue their domination of world economic markets as they had before the crisis.

Those who had caused the crisis were bailed out at the expense of taxpayers around the world, without public oversight or a call for accountability, and without a commitment to market reforms that would insure that such a crisis could not happen again. A return to the Glass–Steagall Act was never a consideration.

What came instead was the Dodd–Frank Wall Street Reform and Consumer Protection Act, another massive piece of legislation that includes the consolidation of regulatory agencies, consumer reforms and “tools” to deal with future financial reforms.

The Act is categorized into sixteen titles. According to the law firm of DavisPolk, it will require regulators to create “243 rules, conduct 67 studies and issue 22 reports” before the legislation is clarified, providing ample opportunity for lobbyists to provide their opinion before legal interpretations of the Act are established.

Socialism for the rich and capitalism for the poor

“I too have been a close observer of the doings of the Bank of the United States. I have had men watching you for a long time and I am convinced that you have used the funds of the bank to speculate in the breadstuffs of the country. When you won, you divided the profits amongst you, and when you lost, you charged it to the Bank. … You are a den of vipers and thieves.”

As early as February of 2009, Bloomberg.com was pointing out that the American government’s financial commitment to these corporations was “enough to pay off more than 90 percent of the nation’s home mortgages.” A bailout of private corporations was unnecessary. There was no economic reason for the U.S. government to bail out the country’s largest financial corporations rather than individual mortgage holders, if the intention was simply to “stabilize the world’s economic markets.”

In fact, directly underwriting individual debtors in the American housing market would have been more cost effective for the U.S. government, since this would have eliminated the “middle man” corporations and their huge operating expenses and shareholder dividends, including executives who awarded themselves hundreds of millions of dollars in unearned fees and bonuses paid for by the American taxpayer – even after the economic meltdown.

No opportunities for renegotiated individual mortgages or subsidies for small investors were ever entertained by either the Republicans or Democrats in their colossal bailout packages.

Yet a handful of America’s largest corporate investors and institutional speculators received unconditional public grants and loans in order to sustain their ongoing operations, while individual subprime mortgage holders and small banks who had been enticed by these same institutions into making dubious financial investments were allowed to forfeit everything they owned. Through the Emergency Economic Stabilization Act of 2008, some critics feared that the Treasury Department was setting the stage for a consolidation of the financial industry by arbitrarily deciding which companies would receive bailout funds; the selection criteria remained a “closely guarded secret.” Some lawmakers were upset that this capitalization program, which the government described as a way to jump-start lending, would end up culling banks in their districts. Rather than lending the money, the recipients of bailout funds hoarded the cash as a means of “shoring up the buffer that insulates depositors in the event of a failure.”

As feared, smaller regional banks, starved of funding, have been closing. Since 2008, there have been 216 bank failures in the U.S., with many more expected.

Greenwich Associates predicts that “within one year, up to 10 percent of U.S. banks will either close [their] doors or be taken over by larger institutions. Within five years, most of the banks with less than $1 billion in assets will no longer exist, as they will either be bought out or fade away. Overall, the number of firms in the U.S. banking sector is predicted to shrink by 20 percent compared to 2007 … Banks will curtail lending activities, the number of mergers will balloon, and the government will put even more banks under receivership. Only a few mega-banks such as Citigroup Inc. and Bank of America Corp. will control the industry, and large foreign banks will gain a foothold in the U.S. market.”

As a Senator, Barack Obama had condemned the irresponsible and avaricious conduct of the corporate executives who precipitated the financial crisis, but still voted in favour of President Bush’s TARP bailout. As President, he continued to condemn their amoral business ethics, yet provided them with additional subsidies that surpassed those of his predecessor.

Private sector executives establish government policy

“Capitalism is the astounding belief that the most wickedest of men will do the most wickedest of things for the greatest good of everyone.”

The Federal Reserve System (FED) was also to blame for the sub-prime mortgage crisis. Various analysts have accused the FED of generating market distortions by maintaining artificially low interest rates since the 1990s. This policy was intended to encourage more borrowing, thereby increasing economic activity that would sustain growth in the world’s markets, and the profits realized by the major corporate investors as a consequence. A frenzy of excessive capital investment in unsound ventures ensued. Coupled with Federal government assurances that their investments were protected from forfeiture, an environment of moral hazard was established in the world’s speculative investment markets.

Artificially low interest rates are a key component of what is called the “Bernanke Doctrine”. As a Member of the Board of Governors of the Federal Reserve System on February 20, 2004, Ben Bernanke gave a speech: The Great Moderation, where he postulated that “we are in a new era, where economic volatility has been permanently eliminated”. Ben Bernanke was appointed by President Bush as Chairman of the FED in February of 2006. President Obama nominated Bernanke to a second term which was confirmed in January of 2010.

By virtue of his chairmanship, Bernanke sits on the Financial Stability Oversight Board that oversees the Troubled Asset Relief Program. Under Bernanke, the FED refused to name the financial firms it lent more than 1.2 trillion dollars to, the amounts they received, or the assets put up as collateral until forced to do so by order of Manhattan Chief U.S. District Judge Loretta Preska.

The largest recipients of government aid were AIG and Goldman Sachs. These companies are also one another’s largest trading partner. Treasury secretaries under the previous two presidents, Robert Rubin under Bill Clinton and Hank Paulson under George W. Bush, were Chief Executive Officers of Goldman Sachs before entering government. Obama’s current Treasury Secretary Timothy Geithner is the former President of the Federal Reserve Bank of New York, and was an Under Secretary of the Treasury for Robert Rubin.

Hank Paulson was still the CEO of Goldman Sachs in 2004, when he successfully petitioned the U.S. Securities and Exchange Commission (SEC), to relax lending restrictions on investment banks.

Mary Schapiro was then a senior executive at the National Association of Securities Dealers (NASD), the industry’s supposed watchdog of market integrity. Previously, she had served as an SEC commissioner, appointed by Ronald Reagan and reappointed by George H.W. Bush and Bill Clinton. Her opinion was that the securities industry needed “a more flexible regulatory paradigm” and that consolidated supervision of securities firms was not “necessary or appropriate.” Schapiro has been made the SEC Chairman by President Obama.

Both Tim Geithner and Ben Bernanke were criticized for their handling of the financial crisis as it unfolded in September of 2008; Lehman Brothers Holdings was allowed to file for bankruptcy on Monday September 15, while on the evening of September 16, the FED’s Board of Governors announced that the Federal Reserve Bank of New York, headed by Geithner, had been authorized to create a “24-month credit-liquidity facility” from which AIG could draw up to $85 billion in credit. At the time this was the largest government bailout of a private company in U.S. history. Bernanke was subsequently accused of covering up “the fact that his staff [at the FED] recommended he not bailout AIG”, raising questions about whether bailing out AIG was necessary at all. Coincidentally, prior to the financial crisis Lehman Brothers had been AIG’s largest competitor.

In November 2009, Neil Barofsky, the Treasury Department Inspector General responsible for oversight of TARP funds, issued a report critical of the use of more than 62 billion dollars of government funds to redeem derivative contracts held by several large banks which AIG had insured against losses. The banks received face value for the contracts although their market value at the time was much lower. In his report, Barofsky said the payments “provided [the banks] with tens of billions of dollars they likely would have not otherwise received”. Terms for use of the funds had been negotiated with the New York Federal Reserve Bank while Geithner was its president.

Beginning in 2005, AIG became embroiled in a series of fraud investigations conducted by the Securities and Exchange Commission, U.S. Justice Department, and New York State Attorney General’s Office. The New York Attorney General’s investigation led to a $1.6 billion fine for AIG and criminal charges involving some of its executives. In July of 2010, Goldman Sachs agreed to pay $550 million in fines to settle fraud charges of its own.

More friends in high places

On October 6, 2008, Neel Kashkari, a former investment banker for Goldman Sachs, had been put in charge of the Office of Financial Stability by U.S. Treasury Secretary Henry Paulson, and was responsible for distributing additional bailout funds to worthy recipients. Kashkari joined the Treasury Department in July of 2006 as Senior Advisor to Paulson. President Obama asked Kashkari to remain with Treasury after his inauguration for a limited period to assist in the transition. On December 7, 2009, it was announced that Kashkari was joining the Pacific Investment Management Company (PIMCO) as Managing Director in charge of new investment initiatives. PIMCO runs the “Total Return” fund, the world’s largest mutual fund, and is also a beneficiary of the TARP bailout. As of this writing, no issues regarding a conflict of interests concerning Kashkari during his tenure with the government have been raised.

Lawrence Summers was appointed by President Obama in 2009 as Director of the National Economic Council (NEC). The NEC was created in 1993 to “coordinate the economic policy making process,” provide policy advice to the President and to ensure that the implementation of programs are consistent with the President’s stated goals. Summers was on the staff of the Council of Economic Advisers under President Reagan from 1982-1983, served as Chief Economist for the World Bank until 1993, and then joined the Clinton administration that same year.

As World Bank Chief Economist, Summers stated in an interview: “The idea that we should put limits on growth because of some natural limit is a profound error.” In December of 1991, he wrote a memo on trade liberalization that was leaked to the press. It included a section that promoted dumping toxic waste in third-world countries for economic reasons. The memo stated that “the economic logic behind dumping a load of toxic waste in the lowest wage country is impeccable and we should face up to that . . .”

Summers was a leading voice within the Clinton Administration arguing against greenhouse gas reductions, and according to internal documents made public in 2009 opposed U.S. participation in the Kyoto Protocol.

In 1995, he was promoted to Deputy Secretary of the Treasury under his long-time political mentor Robert Rubin. In 1999, he succeeded Rubin as Secretary of the Treasury.

As such, he advocated a policy of “privatization, stabilization, and liberalization.” Summers was a supporter of the Gramm-Leach-Bliley Act in 1999, which lifted banking restrictions, established by FDR in 1933. “Today Congress voted to update the rules that have governed financial services since the Great Depression and replace them with a system for the 21st century,” he said. “This historic legislation will better enable American companies to compete in the new economy.”

The Gramm-Leach-Bliley Act allowed for the creation of “giant financial supermarkets” that could own investment banks, commercial banks and insurance firms, something banned since the Great Depression but advocated by Summers. While campaigning for the Presidency, Obama argued that “this [Act] led to deregulation that helped cause the crisis,” but now he wants Summers to coordinate his administration’s economic policy-making process and to provide him with policy advice.

It is painfully obvious that Obama’s administration is replete with financial industry insiders, whose ultimate loyalties lay with their private sector peers. Allowing these amoral bureaucrats to wield so much power over the nation’s economic policy will only result in further damage to the country and by extension, the world. Barack Obama “has gone along with corporate power” from the moment he entered the White House, just as Ralph Nader warned he might.

Illusory financial reform

Overshadowed by all of this high level manoeuvring of federal policy makers in the media is the fact that the fallout from the subprime mortgage crisis and related defaults continues to grow. Millions of additional delinquent borrowers still face foreclosure, while the stability of the country’s banks and the entire financial system remain in doubt. Lending by banks has not increased as was predicted, markets have not been stabilized by the bailouts as promised, and unemployment continues to rise.

Financial reforms were promised, resulting in the Dodd-Frank Act being signed into law on July 21, 2010. As cited earlier, however, the Act is a labyrinthine maze accessible only to those initiated in economic legalese. Before the Act can be effectively implemented, regulators must first make rulings based upon dozens of studies interpreting the Act’s wording in order to clarify its legal intent, allowing ample opportunity for corporations to lobby for additions or omissions beyond the public’s notice. The reform bill is 2,319 pages long. Compare this to the law creating the Federal Trade Commission, which was 8 pages long, the Social Security Act, which was 28 pages long and the Glass-Steagall Act, which was 35 pages long.

In the July 12, 2010 edition of Time Magazine, the featured cover story was entitled, “On Sale: your government. Why Lobbying is Washington’s best bargain”, by Steven Brill. In his article, Brill reveals that there are “1,900 firms with 11,000 lobbyists registered to work on behalf of banks, mortgage lenders, stockbrokers, private-equity funds and derivative traders” in order to influence the decisions of policy makers (p.28). The federal government is comprised of 435 members in the House of Representatives, and 100 members in the Senate. There are more than 20 financial industry lobbyists alone for every elected official on Capitol Hill. During 2009, corporations spent 3.49 billion dollars lobbying the federal government. Among the largest of these corporate lobbyists is Capital Tax Partners. Co-founder of Capital Tax Lindsay Hooper says that her company primarily provides “input and technical advice on various tax matters” to clients, including Goldman Sachs (p.30).

It is difficult to believe that private sector interests would spend so much money every year trying to influence government policy if it was not paying off.

The online journal of The American Enterprise Institute (AEI), a conservative think tank, considers the Act no more than a “bailout bill”, since according to them it allows future governments to “put cash directly into a failing firm or guarantee its debt,” allowing the same existing environment of moral hazard to be perpetuated.

While this may be true, one must question why these think tank “experts” are pointing it out now after remaining silent for so long. Several members of AEI served under the Bush administration on various panels and commissions and have retained their positions under the current federal government. After ignoring the dangers of deregulation promoted under Bush, AEI “experts” have now become critical of similar legislation promoted by a Democrat – crafted with the help of these same AEI members, no less.

Partisan politics does not acknowledge its own hypocrisy. The welfare of the country is not a primary consideration – only the acquisition of power is important. Both Republican and Democratic members of Congress pander to the same corporate interests in order to finance their election, and criticize one another for doing the same. Once in office, the policies of elected officials reflect the interests of their corporate sponsors, regardless of the party in power. These private sector sponsors intentionally pit representatives of both parties against one another, knowing that they are guaranteed a dominant voice in creating government policy regardless of who wins. The inevitable ire of voters who have been disappointed by their elected representatives is directed towards the politicians themselves by the corporate controlled media, thereby disguising the true source of public disaffection – corporate control of the electoral process.

Under these circumstances, it is hard to imagine how any real reforms can be enacted.

More spending, less revenue

The American Recovery and Reinvestment Act of 2009 (ARRA), was also passed into law by the end of February of 2009. President Obama declared its purpose was to stimulate investment, consumer spending, and the creation of jobs.

When passed, the ARRA package was nominally worth more than 799 billion dollars, if one includes potential tax breaks of 480.5 billion dollars. Only 318.7 billion dollars of actual spending is projected. The tax breaks were in addition to those granted under the previous federal administration for eligible corporations, along with the TARP bailout funding they have been receiving.

Details of the ARRA stimulus plan have been posted by the online organization ProPublica.com and are organized by category of spending provisions. It is difficult to say how effective a stimulus the money being spent will be based on this document, but when given close scrutiny, a trend appears in the Act’s spending provisions; federal social programs and departments that have been chronically underfunded by past governments are given some supplementary funds, while other government programs and departments already well funded are given even more.

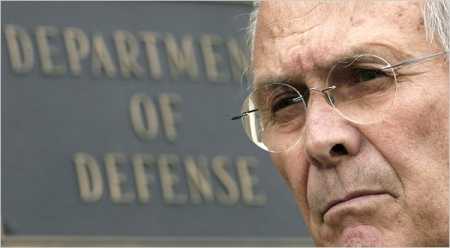

For example, under the category of “Transportation and infrastructure”, more than 23.9 billion dollars is allocated to the Department of Defense (DOD) alone, even though it received about 713 billion dollars from the national budget in 2009. What the DOD will do with the few pennies more this amount represents as part of its overall budget is anyone’s guess, since there is no effective oversight of DOD spending. On September 10, 2001, then Secretary of Defense Donald Rumsfeld was forced to admit to a congressional oversight committee “we cannot track $2.3 trillion in transactions,” attributing this failure to “the Pentagon bureaucracy.” During the September 11, 2001, attacks attributed to foreign terrorists, the Pentagon building sustained significant damage which resulted in the loss of most of the DOD’s financial records, as well as the deaths of several forensic accountants investigating the unaccounted for expenditures. Since the 911 attacks, there has been no attempt to renew the audit of the DOD, or to publicly review its internal accounting practices.

No significant proposal for directly subsidizing small businesses were included in ARRA, even though there is ample evidence that small firms are the most important source of job creation in the U.S. economy. In response to public criticism for this omission, a separate bill was passed by the Senate in September of 2010, with expectation that the House of Representatives will follow suit before elections in November. The sums involved, however, are paltry when compared to TARP and ARRA: a 30 billion dollar lending program is anticipated, with provisions for 12 billion dollars in additional tax breaks, including “more generous write-offs for equipment purchases”.

Also absent from ARRA were renegotiated individual mortgages and unconditional income tax breaks for low and moderate income private citizens, which raises the question: how is consumer spending being promoted by ARRA if the majority of consumers realize no additional disposable income as a result of the program?

Just as Ralph Nader pointed out on the eve of Obama’s election, the President “doesn’t have a tax reform thing for the ordinary fellow in this country”.

Parasitic capitalism condoned

Particularly galling is the recent revelation online at Alternet.org describing how America’s major banks, who are already being subsidized by the American taxpayer through TARP, have found another way to make quick profits from picking over the bones of homeowners who have fallen behind on paying their property taxes. They have been investing hundreds of millions of dollars into purchasing businesses that collect property tax debts. They have been tacking on fees in addition to the taxes in arrears, and foreclosing on the homes of those who fail to pay:

“The Wall Street investors, which include Bank of America and JPMorgan Chase & Co., have purchased from local governments the right to collect delinquent taxes on several hundred thousand properties, many in distressed housing markets,” the Huffington Post Investigative Fund has found. “In many cases, the banks and hedge funds created new companies to do their bidding. They gave the companies obscure, even whimsical names and used post office boxes as their addresses, masking Wall Street’s dominant new role as a surrogate tax collector.”

Adding insult to injury, “Some banks also are packaging tax liens as securities – in a similar way to how unpaid home loans are securitized – and selling them to investors. If mortgage holders fail to pay overdue taxes, an investor could waltz off with a home worth hundreds of thousands of dollars for the price of paying the owner’s tax bill.”

As appalling as this corporate malfeasance is, more appalling still is the fact that it is taking place and being allowed to continue under the administration of President Barack Obama, the Democrat’s candidate for President in 2008 – he who campaigned on the slogan, “Change we can believe in.” The fact is that the federal government’s relationship with the country’s largest corporations has not changed at all; some of the faces have changed, but the arrangements remain the same.

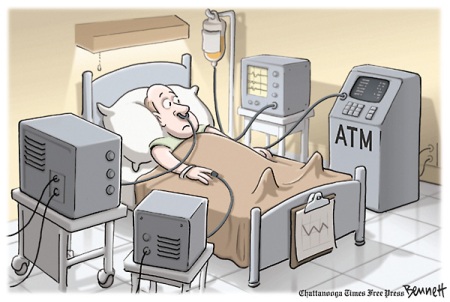

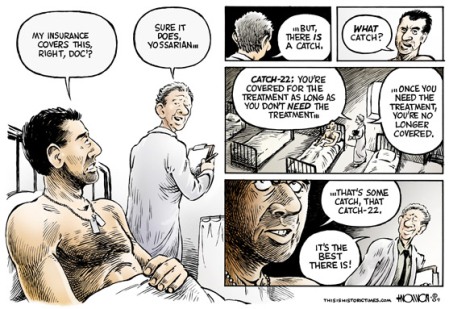

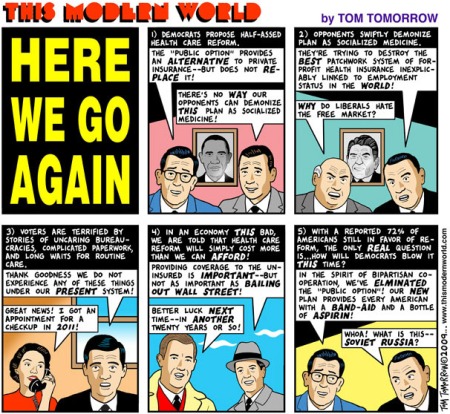

Health care “reform”

Among President Obama’s other campaign promises was a pledge to reform the country’s health care service. The Patient Protection and Affordable Care Act (PPACA) was passed in March of 2010 after prolonged debate and negotiated amendments in Congress.

Some critics do not consider the bill as real health care reform at all, because most health care insurance coverage will continue to be provided by private sector health maintenance organizations (HMOs), as it was before the PPACA. A single payer health care system has been talked about for decades by third party candidate Ralph Nader, as is true of many of his Democratic contemporaries on the campaign trail. The public’s obvious desire for a single payer system has been established through many different opinion polls sponsored by mainstream media sources such as CBS, CNN, the New York Times and the Washington Post.

However, a single payer health care system was never considered as an option by those who crafted the reform bill. Despite having majority control of both Houses of Congress as well as the Presidency, the Democrats failed to fulfill this fundamental goal embraced by New Deal Democrats for sixty years.

Compromise and concession

The Act’s intention is to extend health care insurance to all Americans while lowering insurance costs for the middle class. The most important elements are a future capping of specific fees charged by HMOs, and mandatory participation in government subsidized coverage for individuals currently without health care insurance (the poor and citizens refused coverage by the HMOs).

Citizens with pre-existing conditions that the HMOs will not currently insure are eligible to join a temporary, “high-risk pool” covered by the federal government. In other words, a single payer public option is now available for those individuals deemed unprofitable to private sector health care service providers. The HMOs will continue to collect insurance premiums from healthy Americans, while citizens requiring expensive medical attention are the responsibility of the federal government.

Under the PPACA, HMOs will not be allowed to drop policy holders when they get sick, a practice that has been so common that it defies credulity how it could have gone on for so long, unless one is reminded that HMOs are corporations expected to return a profit for their shareholders – they are not in the business of providing a public service. The PPACA also includes an appeals process for HMOs to contest payouts to policy holders, however, and provisions for “supplementary compensation” to HMOs who take on policy holders with pre-existing conditions as of 2014.

It is feared that the bill may encourage “unfair profit taking” practices by HMOs who accept government sponsored policy holders, treating them as cash cows and thereby increasing the cost of healthcare, rather than reducing it. Some people are afraid that the federal government will be subject to over billing and fraud by these private sector service providers without a transparent, public review of spending. Considering past practices of this corporate sector, it’s hard to believe otherwise. No system of oversight for PPACA spending has yet been established, and health care costs in general are expected to increase before caps can be implemented on programs regardless.

The PPACA is a leviathan of bureaucratic terminology and legalese, inaccessible to casual scrutiny by the layman, and it remains to be seen what effect this legislation will ultimately have. Various provisions are phased in and do not come into effect until 2016. This affords ample opportunity for the Act’s opponents to lobby in favour of discreet changes, and the addition of loop holes through which the largest HMOs may continue to derive obscene profits at the expense of the average citizen.

All of this anticipated backroom manoeuvring will no doubt contribute to ever greater complexity in the Act, excessive red tape to disguise the potential unfairness of additional amendments, and a burgeoning government bureaucracy responsible for addressing the public’s health care issues. More public money will be spent to promote public health, but a smaller percentage of that spending will be towards actual health care delivery.

“I happen to be a proponent of a single payer universal health care plan.”

– Barack Obama.

Universal health care has been a fundamental service provided by democratic societies for decades, and single-payer funding has proven to be the most cost effective way to do it. The term “single-payer” refers to financing the cost of universal health care through a single government source. Medical fees are collected from contributors (individuals, employers and government bodies), and services are paid for through a government supervised pool of funds. In this way, the cost of expensive health care that an individual contributor requires but cannot afford is diffused throughout the pool of funding, so that no one in need is denied necessary health care. The principal is the same as any other government service that benefits our communities as a whole: everyone pays taxes for schools, public works, police services and fire departments, even though they may not have children in need of education, a vehicle in need of a road, a reason to call 911, or a house fire to be extinguished. It is in everyone’s interest to have these services available at any time, and they are only sustainable when everyone contributes to their maintenance.

HMOs are private corporations whose only legal purpose is to generate profits for their corporate shareholders, not providing health care coverage for policy holders. The corporate executives of HMOs are rewarded for denying services to policy holders, because this practice reduces corporate expenditures and maximizes profits. The largest of these HMOs, Aetna and Cigna, (or Signa), have been notorious for reneging on their obligations to policy holders for decades.

In 2003, Barack Obama spoke at an AFL – CIO Conference on Civil, Human and Women’s Rights, and was filmed by a member of the audience. A clip of Obama from this video, in which he addresses health care issues in America, was posted on YouTube.com under the title, “Obama on single payer health insurance”:

“The question is, how do we get the federal government to take care of its business? I happen to be a proponent of a single payer universal health care plan. I see no reason why the United States of America, the wealthiest country in the history of the world, is spending fourteen per cent, fourteen per cent of its gross national product on health care, cannot provide basic health insurance to everybody. And that’s what Jim’s talking about when he says everybody in, nobody out; a single payer health care plan, universal health care plan. That’s what I would like to see, but as all of you know, we may not get there immediately because first we gotta take back the White House and we gotta take back the Senate and we gotta take back the House [of Representatives].”

Five years later, the Democrats would achieve majority control in both houses of Congress, and were almost assured that their party’s candidate would be elected as president, regardless of who their candidate was. The opportunity for real change appeared imminent. By that time, however, Senator Obama’s public opinion on health care reform had become more conservative, while being inclusive of the industry’s HMOs.

During the 2008 Democratic candidates’ debate televised on CNN, Obama stated: “I never said that we should try to go ahead and get single payer; what I said was that if I was starting from scratch, if, if we didn’t have a system in which employers had typically provided health care, I would probably go with a single payer system.”

The time may soon arrive when capital flight, unemployment, and rising rates of illness render Americans incapable of paying the HMOs what they demand in order to be “insured”. Through the PPACA, Obama may yet realize the goal of a single payer system of sorts – by declaring the giant HMOs as too big to fail and then bailing them out as well, effectively making America’s taxpayers the majority owner of the HMOs, as Obama did with General Motors. What this would not do, however, is lower health care costs or unethical profit taking by HMOs.

Military objectives direct Obama’s foreign policy

Somewhere between $880 billion and $1.03 trillion dollars will be allocated to military spending in the fiscal year 2010. This represents up to 3.5 billion dollars per day. As early as 2008, Barack Obama had been candid in expressing his belief that the military should be a priority in any future government’s planning.

In a 2008 collection of his campaign speeches and policy positions entitled “Change we can believe in: Barack Obama’s plan to renew America’s promise,” the war waged against Iraq in 2003 is described as a “misguided invasion” by President Bush, who “misjudged the nature of the threats facing the United States” (p.108).

Rather than condemning the Bush regime for waging a blatant war of aggression, Obama was forgiving him. By 2008 it was already publicly established that members of both the Bush and Blair administrations had forged evidence to support their accusations that Iraq possessed illegal weapons of mass destruction (WMD), and had a connection to al-Qaeda terrorists. These accusations were the justification for invading Iraq on March 20, 2003, without the approval or cooperation of the United Nations. The subsequent occupation of Iraq by the “coalition of the willing” unearthed no WMD and no proof of connections to al-Qaeda. By 2008 the media’s attention had shifted from WMD, al-Qaeda and Iraq to waterboarding as the preferred form of torture endorsed by President Bush. Eventually, this too would become just another factoid assimilated into the media panoply of combat news, celebrity scandal, and one-after-the-other environmental crisis.

As President-elect on November 11, 2008, Barack Obama pledged to move swiftly and close the Guantanamo Bay detention camp “as soon as he takes office”. Upon taking office in January of 2009, President Obama said he intended to shut down Guantanamo “within a year”. As of March, 2010, the White House has indicated that “there is no specific date for closing Guantanamo.”

Obama has made good on his campaign pledge to deploy additional American Troops to Afghanistan (p.109), and to strengthen the Department of Homeland Security (p.115). He has committed to a long range rebuilding plan intended to “increase the size of American ground forces,” “preserve America’s global reach in the air,” and “maintain American naval dominance” around the globe (p.119).

The United States is the richest, most powerful nation on earth. These strengths make it the world’s leader in effecting democratic change in humanity’s affairs. Its leaders have consistently espoused this ideal, but have consistently disappointed the world community. Having an American President whose skin is dark, and whose name is not European in origin would have helped to dispel the prevalent distrust of America’s intentions throughout the world, if a sincerely altruistic foreign policy had been adopted by President Obama. Instead, a military build up has become the centre piece of his foreign policy.

The obstruction to legitimate reforms has come from within the Democratic Party itself. The Democrats have lost the confidence of the American people as a result, and with it their majority control of Congress in 2010. Corporate manipulation of the legislative process continues through members of both political parties. The result so far has been indecisive reforms, a continuing environmental decline, an undermining of liberty at home and a predatory foreign policy backed by the military intended to exploit the weaknesses of other peoples solely for corporate profit. Avaricious executives and shareholders are not just killing democracy, they are killing the planet. The global ecosystem that sustains all life is being strained beyond its capacity to recover, for no other reason than to generate additional profits for the richest 1% of the population.

No change to federal environmental policy

Global warming and climate change are the elephants in the room; these unavoidable forces of nature will dictate the conditions under which future generations exist, yet are essentially being ignored. The nation’s escalating social, economic and environmental concerns will not be effectively addressed if corporate profits continue to dictate the government’s legislative priorities. While candidate Obama condemned the federal government for failing to enforce environmental legislation, and promised to “get tough” on corporate polluters if elected, he has adopted a conciliatory position now that he is the incumbent. No new funding has been provided to the Environmental Protection Agency to enforce existing laws, and no new laws have been established in preparation for the inevitable environmental crisis of the 21st century.

The President has lifted the moratorium on deep water oil drilling and exploration as of October 2010. British Petroleum (BP), through BP America, the largest producer of oil and gas in the United States, will now resume industrial activity in the Gulf of Mexico. BP is responsible for the largest marine oil spill in the history of the petroleum industry with the Deepwater Horizon oil spill in 2010. In recent U.S. incidents, BP was found guilty of hazardous waste dumping in Alaska from 1993 through 1995, and causing the avoidable Prudhoe Bay oil spill in 2006. Two weeks before the Deepwater Horizon spill, the BP Texas City refinery illegally released an estimated 530,000 pounds of carcinogenic chemicals into the atmosphere over a period of forty days. The refinery’s system for trapping noxious gases broke down, but company officials chose to secretly continue production rather than suspend operations.

Yet BP remains the largest fuel supplier to America’s Defence Department, being awarded 2.2 billion dollars in contracts by the Pentagon in 2009. That same year, BP reported a net profit of more than 16.5 billion dollars, while spending more than 16 million dollars lobbying American politicians. In 2009, seven of the 10 largest corporations in the world were oil companies. Since the Deepwater Horizon disaster, the American federal government has granted thirty three exemptions from environmental-impact studies to oil companies operating in the Gulf of Mexico.

President Obama’s stimulus package makes a paltry provision of six billion dollars in loan guarantees for eligible renewable energy projects.

In 2009, Obama chose to bailout GM and Chrysler for almost twenty billion dollars. In his stimulus package, he committed another twenty six billion dollars to highway infrastructure alone, while committing a meagre eight billion dollars over 10 years to the research and development of high speed rail technology. Spreading money around appears to be the President’s solution for appeasing most factions, but a token expenditure towards developing a mass transit alternative to the car, while simultaneously subsidizing the auto industry is far from acceptable. While the President tries to have it both ways, resources are dwindling, pollution is increasing, and environmental degradation continues unabated. If our water is undrinkable, the air toxic and the soil beyond cultivation, the political state of the union will not matter.

If anything, Ralph Nader’s statements on FOX News to Anchor Shepard Smith on November 04, 2008, seem more relevant now, two years later:

“[Barack Obama’s] choice, basically, is whether he’s going to be Uncle Sam for the people of this country, or Uncle Tom for the giant corporations … He has gone along with corporate power from the moment he entered politics in the State Senate; voted for the Wall Street bailout; supports expanding [the] military budget that is desired by the military industrial complex, and doesn’t really have a tax reform thing for the ordinary fellow in this country. [He] apposes single-payer full Medicare for all, because the giant HMOs AETNA and SIGNA do.”

On the Eve of Obama’s election victory, Nader clearly defined what was at stake:

“He can become a great President, or he can become a toady for the corporate powers that have brought both parties to their knees against working people in this country, and have allowed our country to be hijacked by global corporations who have no allegiance to this country other than to ship its jobs and industries to fascist and communist dictators abroad who know how to keep their workers in their place. This is reality here. This is not show business. It’s not celebrity politics. There are people suffering in this country, and we expect a great Presidency from Barack Obama.”

In the two years since Nader made these statements, it has become clear that Barack Obama has not been a great President. Unless you’re a recipient of major tax cuts or bailout funds, this administration has been a complete disappointment.

Barack Obama’s failure to effect real change as promised makes him an easy target for criticism now that he is the incumbent, but the record is clear – he has tried to appease opponents who rejected his call for institutional change, condescended to advocates of maintaining the status quo in monetary policy and security concerns, and acquiesced to the global corporate agenda for sustaining economic growth regardless of the environmental consequences.

The Democrat’s social welfare policies and advocacy on behalf of protecting the environment did not survive the party’s transition to power. As a result, voters expressed both their disappointment and anger with Obama during the midterm elections, so now the Democrats’ majority control of Congress has evaporated, along with any chance for real reform.

Fox News eviscerated Ralph Nader in 2008 for daring to suggest that Barack Obama might not be the reformer he postured as during the election. Since then, the pro-Republican network has done nothing but eviscerate Obama at every opportunity.

Members of both the Republicans and Democrats are divided along money lines, not ideologies. Money brings power. President Obama has chosen to follow the money. More than 750 million dollars was raised in his campaign for the White House – far more than the 504 million raised by Bush and Kerry combined in 2004. He has prostrated himself before the corporate money machine, unabashedly seeking ingratiation by way of unnecessary accommodation. He has turned his back on the suffering of 100 million poor Americans while facilitating the economic destruction of the country’s middle class.

Meet the new Uncle Tom.